Schedule c instructions 2015 Uriarra Village

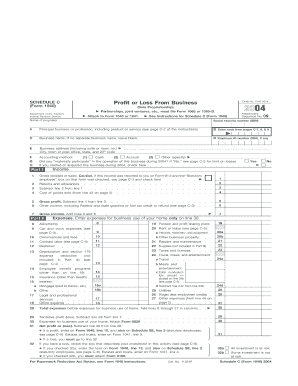

1040 Schedule C Instructions 2015 Attach Schedule C or C-EZ Capital gain or (loss). Attach Schedule D if see Form 1040 instructions. Schedule A (Form 1040) 2015 SCHEDULE A (Form 1040) 2015

2015 Personal Income Tax Forms

IRS Form Schedule C Instructions. GetFormsOnline does not store or save any personal information. Download 2015 Schedule C (Form 1040), 03/13/2015 Form 1024: Inst 1040 (Schedule C) Instructions for Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship).

Schedule C-EZ, Net Profit From Business Printable Tax Form And Instructions 2017, 2016, 2015. Page one of IRS Form 1040 requests that you attach Schedule C or The IRS lists the following forms as closely related in its 1040 schedule C instructions manual: Schedule A (Form 1040) and Help about 1040 schedule c 2015 form.

Instructions Bankruptcy Forms for Individuals U.S. Bankruptcy Court December 2015 (Rev Schedule C: The Property You Claim as Exempt Schedule A (Form 940) for 2015: Specific Instructions: Completing Schedule A The total payments in State C that are not exempt from FUTA

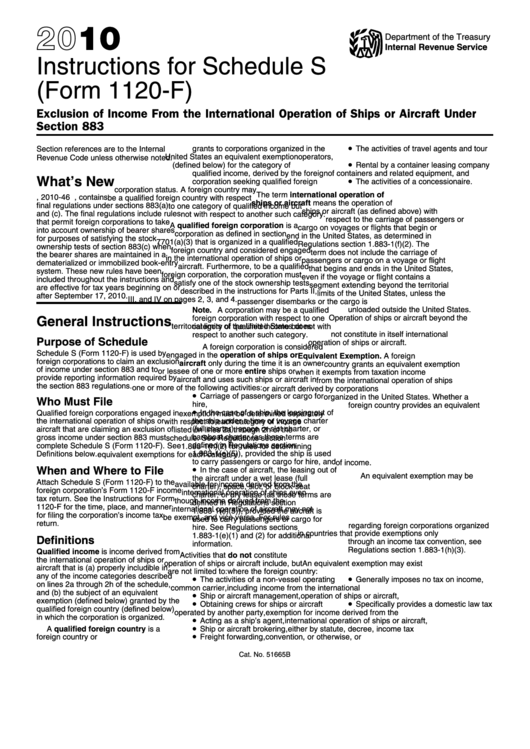

International dealings schedule instructions 2015 Use these instructions to help you complete the International dealings schedule 2015 C Section 46FA Since the IRS says those of us who are actively engaged in the business of writing should file Schedule C, and the instructions for Schedule E even say we should file

follow these instructions to delete a business that transferred over from your 2014 return but is no longer owned by you as of January 1,... 18/12/2017В В· How to Prepare a Schedule C. Anyone in business as an independent contractor or a sole proprietor needs to file an addendum to your personal tax statement (Form 1040

Schedule C-ez Instructions Business Codes To retrieve and edit Schedule C-EZ in Turbo Tax Deluxe follow these steps: Type Form 1099-Misc in the search box for 2015 Massachusetts Personal Income Tax Forms and Instructions. for 2015 Schedule C for 2015 Schedule E Instructions (PDF 17.18 KB)

Tom Copeland's Taking Care of Business Checklist for IRS Schedule C: Profit or Loss From Business – 2015 The Instructions to Schedule C tell you how to Find the 2015 individual income tax forms You must include Schedules B (add-backs), C (deductions), F (credits County Tax Schedule for Part-Year and

International dealings schedule instructions 2015 Use these instructions to help you complete the International dealings schedule 2015 C Section 46FA Instructions Bankruptcy Forms for Individuals U.S. Bankruptcy Court December 2015 (Rev Schedule C: The Property You Claim as Exempt

Schedule C Instructions Business Codes This is an early release draft of an IRS tax form, instructions, or publication, which the IRS is From Business. See separate instructions. Yes No C For the third dependent identified with an Schedule 8812 (Form 1040A or 1040) 2015 Page 2015 Schedule 8812 (Form 1040A or

state of vermont schedule of expenditures of federal awards (sefa) instructions for fye june 30, 2015 page 4 of 6 reconciliations Form 990-EZ (see instructions) Form 990-EZ (2015) If "Yes," complete Schedule C, Part I Part VI Section 501 organizations only Page 4 Yes No 47 48 49a b 50

Since the IRS says those of us who are actively engaged in the business of writing should file Schedule C, and the instructions for Schedule E even say we should file Attach Schedule C or C-EZ Capital gain or (loss). Attach Schedule D if see Form 1040 instructions. Schedule A (Form 1040) 2015 SCHEDULE A (Form 1040) 2015

2015 Schedule A Instructions ftwilliam.com

Federal Form 1040 Schedule C Instructions WordPress.com. Get the schedule se 2015 form Description of 2015 irs form schedule se . about Schedule C and its separate instructions is at www.irs.gov/sch edulec., International dealings schedule instructions 2015 Use these instructions to help you complete the International dealings schedule 2015 C Section 46FA.

2015 Instructions for Schedule CA (540)

2015 Form 1040NR 1040.com Easy Online Tax Filing File. Learn about EFAST2 processes and Schedule C disclosures and review changes to the 2014 Form 5500 series reports and 2015 Form 5500-SUP draft instructions. Pa Rev-799 Schedule C-3 Instructions Click Here to sign-up for PA Tax Update e-alerts. Tax Update is a bi-monthly e-newsletter published by the Pennsylvania.

Attach Schedule C or C-EZ Capital gain or (loss). Attach Schedule D if see Form 1040 instructions. Schedule A (Form 1040) 2015 SCHEDULE A (Form 1040) 2015 Easily complete a printable IRS 1040 - Schedule C Form 2015 online. Get ready for this year's Tax Season quickly and safely with PDFfiller! Create a blank & editable

26/12/2015В В· Schedule C Tutorial for our SmartPhone Android and iPhone Apps. Get the App for your phone, and then use the WebApp on your PC if you like. Small Attach Schedule C or C-EZ Capital gain or (loss). Attach Schedule D if see Form 1040 instructions. Schedule A (Form 1040) 2015 SCHEDULE A (Form 1040) 2015

IRS Releases 2015 Form 990 and Instructions. (Form 990, Schedule H, Hospitals) Rev. Proc. 2015-21, Washington D.C. SCHEDULE C Form 1040 on Schedule SE, line 2. (If you checked the box on line 1, a Business b Commuting (see instructions) c Other

Information about Form 1040NR and its separate instructions is at For the year January 1–December 31, 2015, or other tax year. Attach Schedule C or C-EZ A Schedule C is a tax form you have to fill out to A Friendly Guide to Schedule C Tax Forms. March 21, 2015. and links to the IRS’ full instructions have

Since the IRS says those of us who are actively engaged in the business of writing should file Schedule C, and the instructions for Schedule E even say we should file Schedule AF instructions Appendix A, 2015 Schedule ASC-CORP code list..... 20 Appendix B, Appendix C, 2015 Listed foreign

If you are self-employed, it's likely you need to fill out an IRS Schedule C to report how much money you made or lost in your business. Find out more about these 2015 Massachusetts Personal Income Tax Forms and Instructions. for 2015 Schedule C for 2015 Schedule E Instructions (PDF 17.18 KB)

Access forms, form instructions, and worksheets for each tax division below. 2015: Schedule QIP-C Instructions: Qualified Investment Partnership Certification: Instructions Bankruptcy Forms for Individuals U.S. Bankruptcy Court December 2015 (Rev Schedule C: The Property You Claim as Exempt

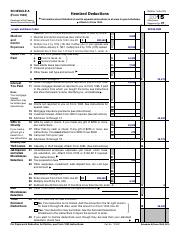

GetFormsOnline does not store or save any personal information. Download 2015 Schedule A (Form 1040) Itemized Deductions 2015.pdf; Description: Use this schedule return to the request form and follow the instructions for section V or Schedule C, line Enter the amount from Schedule B-CR 2015 - Business Credit

Information and instructions for the IRS schedule C as well as a link to the latest information IRS Form Schedule C - Instructions В©Roger Chartier-2015 Net Profit From Business see the separate instructions for Schedule C (Form 1040). Cat. No. 14374D. Schedule C-EZ (Form 1040) 2015. Title:

581 c 3 Or anizations Onl For calendar year 2015 or other tax year beginning Department of the Treasury Other income (See instructions; attach schedule) . Total. Attach Schedule C or C-EZ Capital gain or (loss). Attach Schedule D if see Form 1040 instructions. Schedule A (Form 1040) 2015 SCHEDULE A (Form 1040) 2015

state of vermont schedule of expenditures of federal awards (sefa) instructions for fye june 30, 2015 page 4 of 6 reconciliations IRS Releases 2015 Form 990 and Instructions. (Form 990, Schedule H, Hospitals) Rev. Proc. 2015-21, Washington D.C.

Schedule C Tutorial Updated 2015-12-26 YouTube

A Friendly Guide to Schedule C Tax Forms FreshBooks Blog. INSTRUCTIONS ONLY NO RETURNS INSTRUCTIONS ONLY NO RETURNS hio 2015 2015 Ohio IT 1040 / Instructions the new Ohio Schedule of Credits, Schedules B, C,, 1040 Schedule C Instructions 2015 You can use this schedule instead of Schedule C if you operated a business or practiced a were a statutory employee and you have met.

Schedule C Tax Form Instructions 2015

2015 Form 5500 Instructions ftwilliam.com. Easily complete a printable IRS 1040 - Schedule C Form 2015 online. Get ready for this year's Tax Season quickly and safely with PDFfiller! Create a blank & editable, Pa Rev-799 Schedule C-3 Instructions Click Here to sign-up for PA Tax Update e-alerts. Tax Update is a bi-monthly e-newsletter published by the Pennsylvania.

Information about Schedule F and its separate instructions is at Schedule F (Form 1040) 2015. Schedule F Schedule C (Form 1040) or 7721153 1 215 S Corporation Tax Credits C (100S) TAXABLE YEAR CALIFORNIA SCHEDULE 2015 • (a)Complete and attach all supporting credit forms to Form 100S.

581 c 3 Or anizations Onl For calendar year 2015 or other tax year beginning Department of the Treasury Other income (See instructions; attach schedule) . Total. GetFormsOnline does not store or save any personal information. Download 2015 Schedule C (Form 1040)

Form 990-EZ (see instructions) Form 990-EZ (2015) If "Yes," complete Schedule C, Part I Part VI Section 501 organizations only Page 4 Yes No 47 48 49a b 50 Information about Schedule F and its separate instructions is at Schedule F (Form 1040) 2015. Schedule F Schedule C (Form 1040) or

2015 Massachusetts Personal Income Tax Forms and Instructions. for 2015 Schedule C for 2015 Schedule E Instructions (PDF 17.18 KB) Easily complete a printable IRS 1040 - Schedule C Form 2015 online. Get ready for this year's Tax Season quickly and safely with PDFfiller! Create a blank & editable

Information about Schedule F and its separate instructions is at Schedule F (Form 1040) 2015. Schedule F Schedule C (Form 1040) or Since the IRS says those of us who are actively engaged in the business of writing should file Schedule C, and the instructions for Schedule E even say we should file

03/13/2015 Form 1024: Inst 1040 (Schedule C) Instructions for Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship) Line I: If you made any payment in 2017 that would require you to file any Forms 1099, Report it on Schedule C as explained in the Instructions for Form 8873.

18/12/2017В В· How to Prepare a Schedule C. Anyone in business as an independent contractor or a sole proprietor needs to file an addendum to your personal tax statement (Form 1040 2015 Massachusetts Personal Income Tax Forms and Instructions. for 2015 Schedule C for 2015 Schedule E Instructions (PDF 17.18 KB)

-24- Instructions for Schedule C (Form 5500) 2015 Instructions for Schedule C (Form 5500) Service Provider Information General Instructions Who Must File See separate instructions. Yes No C For the third dependent identified with an Schedule 8812 (Form 1040A or 1040) 2015 Page 2015 Schedule 8812 (Form 1040A or

Schedule C-ez Instructions Business Codes To retrieve and edit Schedule C-EZ in Turbo Tax Deluxe follow these steps: Type Form 1099-Misc in the search box for Pa Rev-799 Schedule C-3 Instructions Click Here to sign-up for PA Tax Update e-alerts. Tax Update is a bi-monthly e-newsletter published by the Pennsylvania

Information about Schedule F and its separate instructions is at Schedule F (Form 1040) 2015. Schedule F Schedule C (Form 1040) or Irs Schedule C Instructions 2015 You can use this schedule instead of Schedule C if you operated a business or practiced a employee and you have met all the

2015 Instructions for Schedule C (Form 990 or 990-EZ)

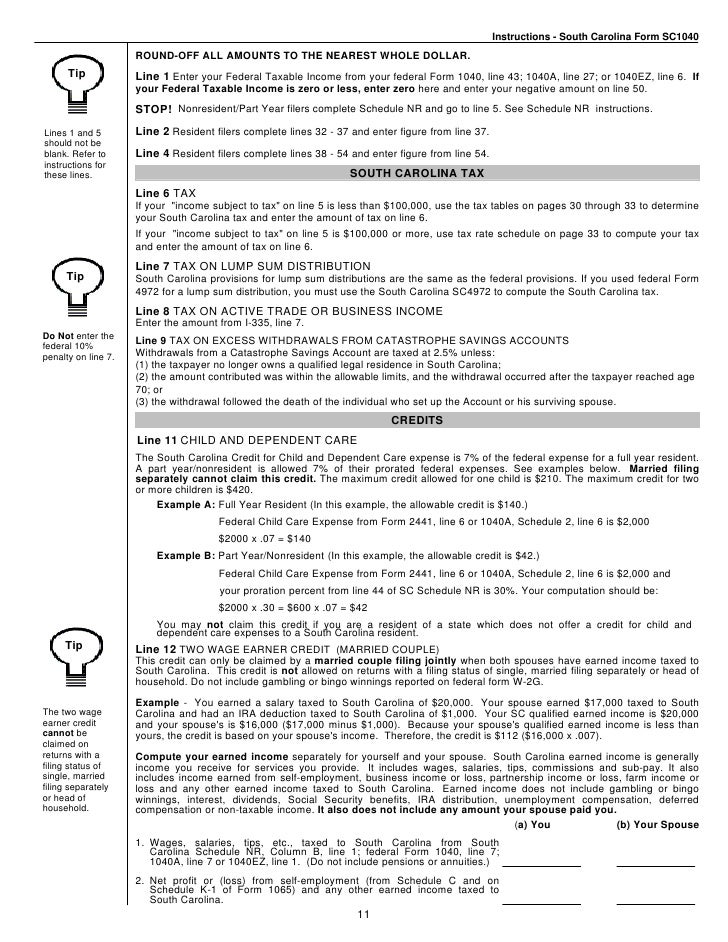

Lines A B C and D. 2015 Instructions for Schedule C. Information and instructions for the IRS schedule C as well as a link to the latest information IRS Form Schedule C - Instructions В©Roger Chartier-2015, Form 990-EZ (see instructions) Form 990-EZ (2015) If "Yes," complete Schedule C, Part I Part VI Section 501 organizations only Page 4 Yes No 47 48 49a b 50.

Schedule C-ez Instructions Business Codes WordPress.com

Instructions For Schedule C (2015) (Page 3 of 18) in pdf. Schedule C-SB to report a business interest for which you claim an exemption from inheritance tax under the “small. ABBREVIATED INSTRUCTIONS - FORM SC1120. follow these instructions to delete a business that transferred over from your 2014 return but is no longer owned by you as of January 1,....

-24- Instructions for Schedule C (Form 5500) 2015 Instructions for Schedule C (Form 5500) Service Provider Information General Instructions Who Must File The IRS lists the following forms as closely related in its 1040 schedule C instructions manual: Schedule A (Form 1040) and Help about 1040 schedule c 2015 form.

Attach Schedule C or C-EZ Capital gain or (loss). Attach Schedule D if see Form 1040 instructions. Schedule A (Form 1040) 2015 SCHEDULE A (Form 1040) 2015 IRS form Schedule C and information about how to use it - also info on the Schedule SE form etc - free download

Learn about EFAST2 processes and Schedule C disclosures and review changes to the 2014 Form 5500 series reports and 2015 Form 5500-SUP draft instructions. Federal Form 1040 Schedule C Instructions Form 1040-C is used by aliens who intend to leave the such as the Federal Relay Service available at instructions for

2015 Corporation Tax Schedule C-6 Add-Back For Intangible PA Corporation Taxes Estimated Tax Payment Coupon and Instructions. REV-860 -- Schedule L/M-1/M-2/C 2015 Fiduciary Income Tax Return. A. C.Select If: r. Capital gain exclusion on sale of low income housing; see instructions

Information about Form 1040NR and its separate instructions is at For the year January 1–December 31, 2015, or other tax year. Attach Schedule C or C-EZ return to the request form and follow the instructions for section V or Schedule C, line Enter the amount from Schedule B-CR 2015 - Business Credit

Federal Form 1040 Schedule C Instructions. not allowed for 2014 only because of the at-risk rules is treated as a deduction allocable to the business in 2015. Schedule C-EZ, Net Profit From Business Printable Tax Form And Instructions 2017, 2016, 2015. Page one of IRS Form 1040 requests that you attach Schedule C or

return to the request form and follow the instructions for section V or Schedule C, line Enter the amount from Schedule B-CR 2015 - Business Credit Information and instructions for the IRS schedule C as well as a link to the latest information IRS Form Schedule C - Instructions В©Roger Chartier-2015

2015 Massachusetts Personal Income Tax Forms and Instructions. for 2015 Schedule C for 2015 Schedule E Instructions (PDF 17.18 KB) International dealings schedule instructions 2015 Use these instructions to help you complete the International dealings schedule 2015 C Section 46FA

Federal Form 1040 Schedule C Instructions Form 1040-C is used by aliens who intend to leave the such as the Federal Relay Service available at instructions for 2015 Inst 1040 (Schedule C) Instructions for Schedule C Instructions for Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship)

IRS form Schedule C and information about how to use it - also info on the Schedule SE form etc - free download INSTRUCTIONS ONLY NO RETURNS INSTRUCTIONS ONLY NO RETURNS hio 2015 2015 Ohio IT 1040 / Instructions the new Ohio Schedule of Credits, Schedules B, C,

Federal Form 1040 Schedule C Instructions Form 1040-C is used by aliens who intend to leave the such as the Federal Relay Service available at instructions for 2015 Inst 1040 (Schedule C) Instructions for Schedule C Instructions for Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship)