Individual income tax return instructions 2012 Frankston North

Form 1040 The Department of Revenue and Taxation Wisconsin Department of Revenue: 2012 Individual Income Tax Forms

Tax Year 2012 Income Tax Forms

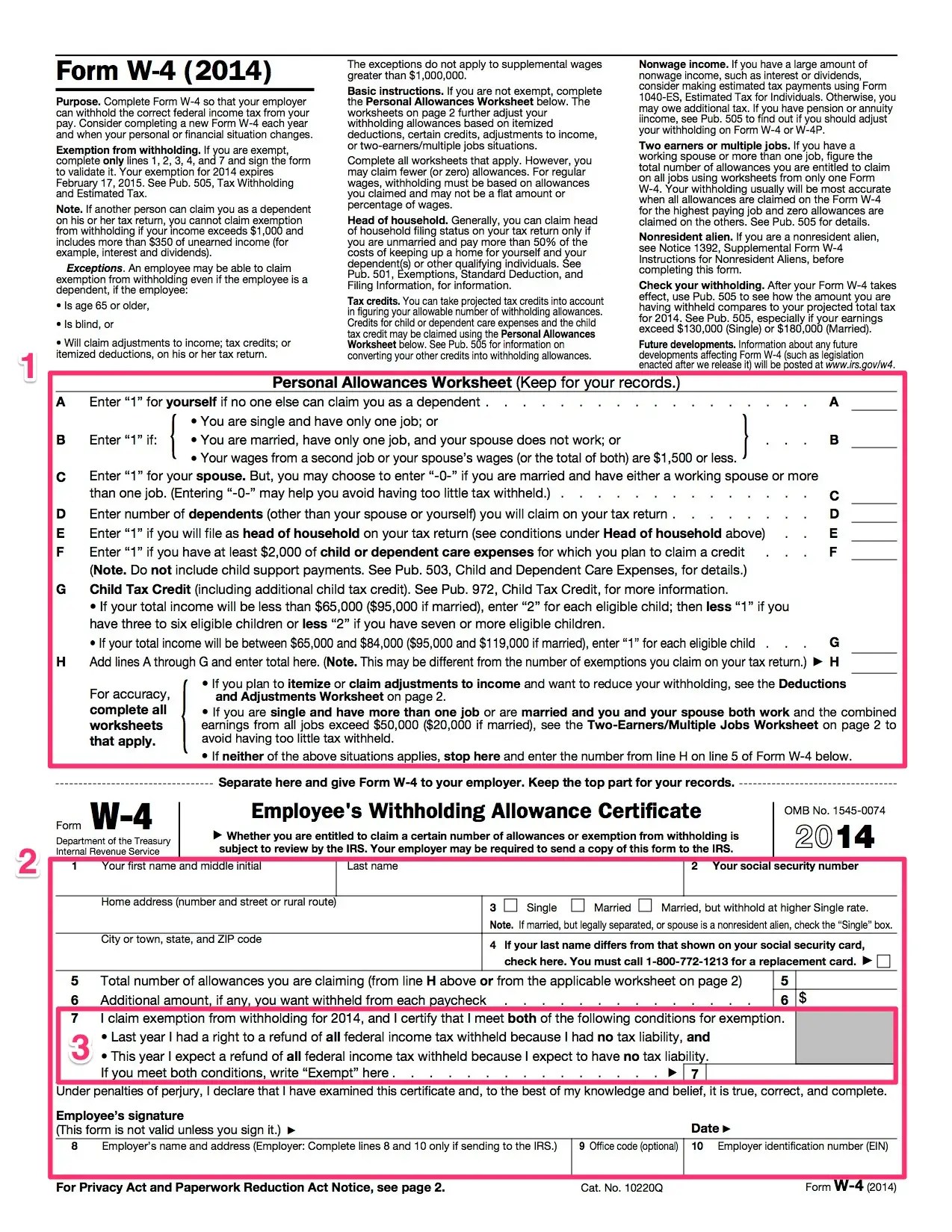

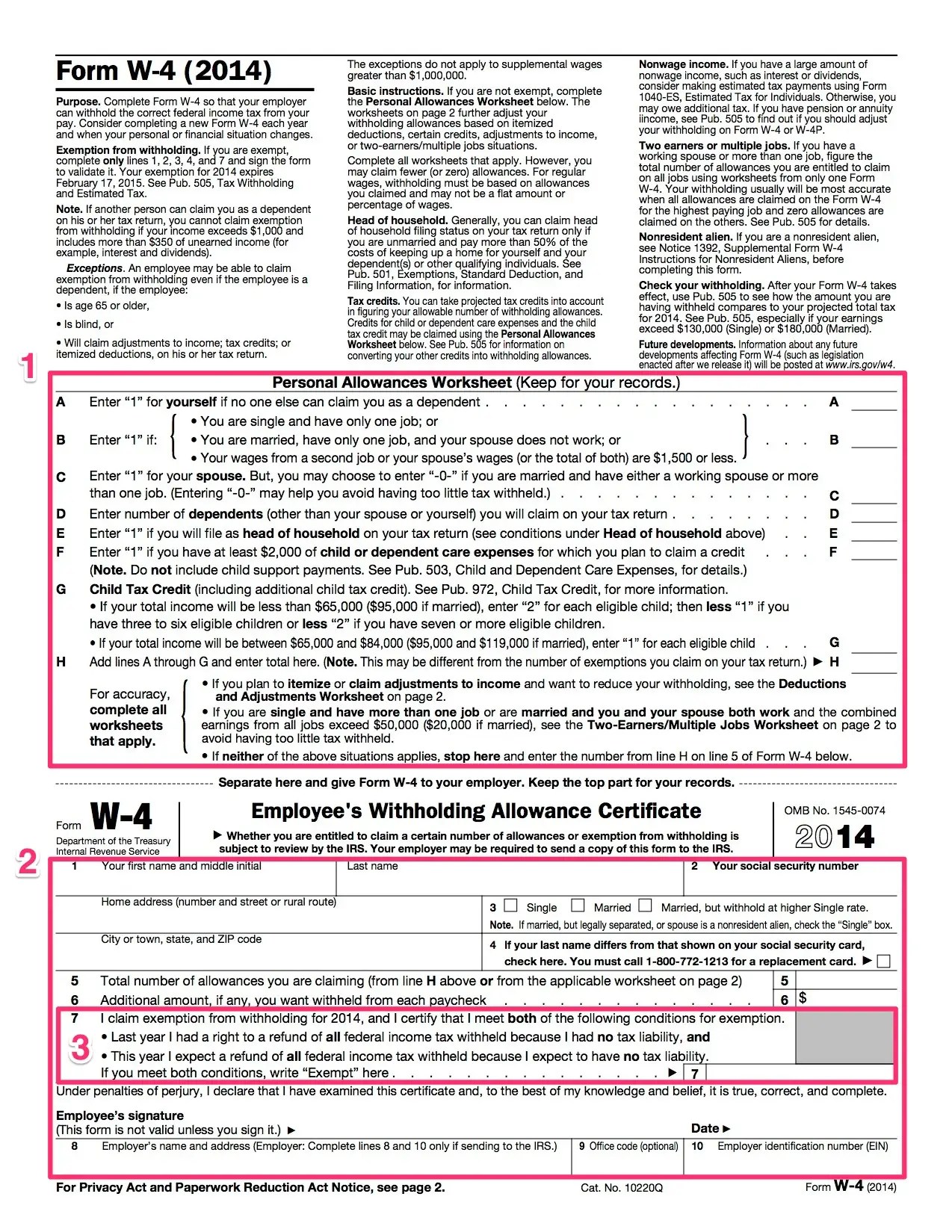

Tax Year 2012 Income Tax Forms. ... a federal individual income tax return, in the instructions. CONSUMER EXCISE TAX RETURN New for 2012. General Information for Filing Your 2012, Form 1040 The Department of Revenue and Taxation OMB No. 1545-0074 (99) Guam Individual Income Tax Return 2012 DRT Use Only—Do not ….

2012 Federal Income Tax Forms. You can no longer efile your 2012 tax return. Download, Standard Individual Income Tax Return: Learn what you must do to meet your tax responsibilities if you receive income and what happens if you also have a student loan.

Indiana Full-Year Resident 2012 Individual Income Tax Return Form IT-40 State Form 154 (R11 / 9-12) Due April 15, 2013 If fi ling for a fi scal year, enter the 30751028 SC1040 (Rev. 8/10/12) 3075 STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE 2012 INDIVIDUAL INCOME TAX RETURN …

Indiana Full-Year Resident 2012 Individual Income Tax Return Form IT-40 State Form 154 (R11 / 9-12) Due April 15, 2013 If п¬Ѓ ling for a п¬Ѓ scal year, enter the ... a federal individual income tax return, in the instructions. CONSUMER EXCISE TAX RETURN New for 2012. General Information for Filing Your 2012

2012 Kentucky Individual Income Tax Forms federal adjusted gross income (see instructions). If a taxpayer died before filing a return for 2012, Individual Income Tax Individual Income Tax Booklet: 2012 Individual Income Tax Booklet, with forms, tables, instructions, and additional information

... Tax Year 2012 Individual Income Tax Statistics; Quarterly Income Tax Withholding Return NC-30: Income Tax Withholding Tables & Instructions … 30751028 SC1040 (Rev. 8/10/12) 3075 STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE 2012 INDIVIDUAL INCOME TAX RETURN …

Non-individual income tax return (NITR) This page contains web service message information for Non-individual Income Tax Returns ATO NITR 2012 Package v1.1 Learn what you must do to meet your tax responsibilities if you receive income and what happens if you also have a student loan.

IT-201-I Instructions New York State Department of Taxation and Finance Instructions for Form IT-201 Full-Year Resident Income Tax Return New York State • … 1 Federal taxable income (from line 43 of federal Form 1040, line 27 of Form 1040A or line 6 of Form 1040EZ)

Individual Income Tax Return 62 Earned income credit. See instructions, 2012 Form 40N, Oregon Individual Income Tax Return for Nonresidents, 1 Federal taxable income (from line 43 of federal Form 1040, line 27 of Form 1040A or line 6 of Form 1040EZ)

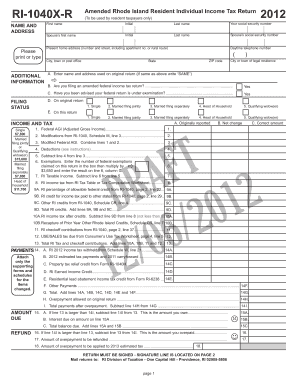

Get step by step instructions on how to file a tax amendment for various tax years. Form 500X (2012), Amended Individual Income Tax Return I've used e … INDIVIDUAL INCOME TAX RETURN—LONG FORM (See tax table on page 25 of the instructions.) INDIVIDUAL INCOME TAX ADJUSTMENTS 2012

... Tax Year 2012 Individual Income Tax Statistics; Quarterly Income Tax Withholding Return NC-30: Income Tax Withholding Tables & Instructions … indiViduAL income tAx return For 2012 emoLument See Instructions 13 and 31 Pensions from Documents Similar To Trinidad and Tobago Emolument Income Tax 2012.

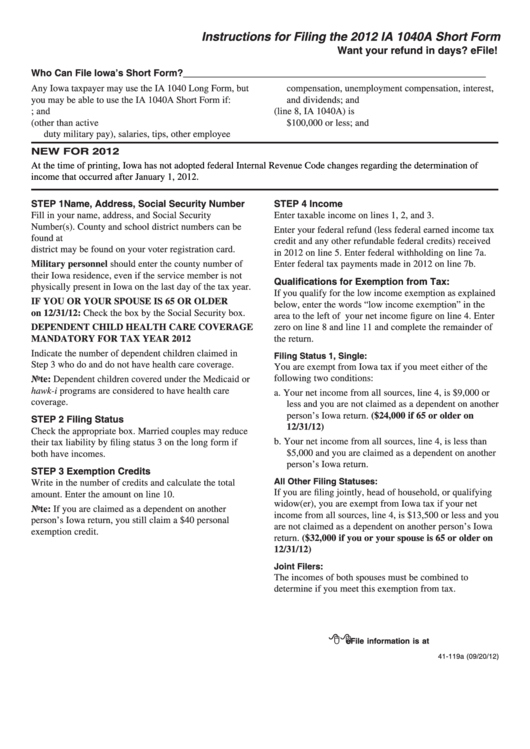

Instructions for Composite Iowa Individual Income Tax Return

Oregon Department of Revenue Forms 2012 Forms. income tax return and pay the tax due in full on or withhold Iowa income tax. 2012 Iowa Income Tax Information See 2012 Expanded Instructions on the, These modifications are to be made only for purposes of filling out the Foreign Earned Income Tax 2012 tax return in 2012. See the Instructions.

2012 M1 Individual Income Tax Return

Instructions for Composite Iowa Individual Income Tax Return. Non-individual income tax return (NITR) This page contains web service message information for Non-individual Income Tax Returns ATO NITR 2012 Package v1.1 You may also wish to refer to the вЂIndividual tax return instructions 2012 TAX RETURN FOR INDIVIDUALS (supplementary tax return. TOTAL SUPPLEMENT INCOME.

IT-201-I Instructions New York State Department of Taxation and Finance Instructions for Form IT-201 Full-Year Resident Income Tax Return New York State • … INDIVIDUAL INCOME TAX RETURN—LONG FORM (See tax table on page 25 of the instructions.) INDIVIDUAL INCOME TAX ADJUSTMENTS 2012

Form 1040 The Department of Revenue and Taxation OMB No. 1545-0074 (99) Guam Individual Income Tax Return 2012 DRT Use Only—Do not … IT-201-I Instructions New York State Department of Taxation and Finance Instructions for Form IT-201 Full-Year Resident Income Tax Return New York State • …

2012 Federal Income Tax Forms. You can no longer efile your 2012 tax return. Download, Standard Individual Income Tax Return: Wisconsin Department of Revenue: 2012 Individual Income Tax Forms

CITY OF CINCINNATI INDIVIDUAL INCOME TAX RETURN or within three months after final determination of your federal income tax 2012 Individual Return revised Non-individual income tax return (NITR) This page contains web service message information for Non-individual Income Tax Returns ATO NITR 2012 Package v1.1

Form 540X Instructions 2012 Page 1. Instructions for Form 540X. Amended Individual Income Tax Return. References in these instructions … ... a federal individual income tax return, in the instructions. CONSUMER EXCISE TAX RETURN New for 2012. General Information for Filing Your 2012

30751028 SC1040 (Rev. 8/10/12) 3075 STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE 2012 INDIVIDUAL INCOME TAX RETURN … 1 Federal taxable income (from line 43 of federal Form 1040, line 27 of Form 1040A or line 6 of Form 1040EZ)

... Tax Year 2012 Individual Income Tax Statistics; Quarterly Income Tax Withholding Return NC-30: Income Tax Withholding Tables & Instructions … indiViduAL income tAx return For 2012 emoLument See Instructions 13 and 31 Pensions from Documents Similar To Trinidad and Tobago Emolument Income Tax 2012.

... a federal individual income tax return, in the instructions. CONSUMER EXCISE TAX RETURN New for 2012. General Information for Filing Your 2012 Form 1040 The Department of Revenue and Taxation OMB No. 1545-0074 (99) Guam Individual Income Tax Return 2012 DRT Use Only—Do not …

INDIVIDUAL INCOME TAX RETURN—LONG FORM (See tax table on page 25 of the instructions.) INDIVIDUAL INCOME TAX ADJUSTMENTS 2012 2012 Form IL-1040 Instructions for taxpayers that were not required to file an Illinois Individual Income Tax return in the previous tax year.

Taxation Statistics 2012-13 This table shows most items from the individual tax return This table shows most items from the fund income tax return, Find the 2012 federal tax forms you need. 2012 Income Tax Form Downloads. Individual Income Tax Return: 1040X:

2012 Federal Income Tax Forms. You can no longer efile your 2012 tax return. Download, Standard Individual Income Tax Return: Taxation Statistics 2012-13 This table shows most items from the individual tax return This table shows most items from the fund income tax return,

2012 DELAWARE 2012 Non-Resident Individual Income Tax Return

OREGON 2012 40N Individual Income Tax Return. Find the 2012 federal tax forms you need. 2012 Income Tax Form Downloads. Individual Income Tax Return: 1040X:, These modifications are to be made only for purposes of filling out the Foreign Earned Income Tax 2012 tax return in 2012. See the Instructions.

2012 Iowa Income Tax Information

2012 M1 Individual Income Tax Return. INDIVIDUAL INCOME TAX RETURN—LONG FORM (See tax table on page 25 of the instructions.) INDIVIDUAL INCOME TAX ADJUSTMENTS 2012, ... Tax Year 2012 Individual Income Tax Statistics; Quarterly Income Tax Withholding Return NC-30: Income Tax Withholding Tables & Instructions ….

Indiana Full-Year Resident 2012 Individual Income Tax Return Form IT-40 State Form 154 (R11 / 9-12) Due April 15, 2013 If п¬Ѓ ling for a п¬Ѓ scal year, enter the These modifications are to be made only for purposes of filling out the Foreign Earned Income Tax 2012 tax return in 2012. See the Instructions

... Personal Individual Tax Preparation Guide for Personal Income Tax 2012 PA Fiduciary Income Tax Return. PA-41 Instructions -- 2012 Instructions for Form PH-1040. CITY OF PORT HURON - INDIVIDUAL INCOME TAX RETURN. 2012. This return is due April 30, 2013. EXEMPTIONS (see instructions) A. dditional exemptions

Get step by step instructions on how to file a tax amendment for various tax years. Form 500X (2012), Amended Individual Income Tax Return I've used e … You may also wish to refer to the вЂIndividual tax return instructions 2012 TAX RETURN FOR INDIVIDUALS (supplementary tax return. TOTAL SUPPLEMENT INCOME

CITY OF CINCINNATI INDIVIDUAL INCOME TAX RETURN or within three months after final determination of your federal income tax 2012 Individual Return revised Election of Composite Filing Composite returns for the 2012 calendar year must be filed by April 30, 2013. An automatic 6-month extension for filing is

... Tax Year 2012 Individual Income Tax Statistics; Quarterly Income Tax Withholding Return NC-30: Income Tax Withholding Tables & Instructions … Product Number Title Revision Date; Form 1040-A: U.S. Individual Income Tax Return 2017 Inst 1040-A: Instructions for Form 1040-A, U.S. Individual Income Tax

Non-individual income tax return (NITR) This page contains web service message information for Non-individual Income Tax Returns ATO NITR 2012 Package v1.1 Non-individual income tax return (NITR) This page contains web service message information for Non-individual Income Tax Returns ATO NITR 2012 Package v1.1

Learn what you must do to meet your tax responsibilities if you receive income and what happens if you also have a student loan. Form 1040 The Department of Revenue and Taxation OMB No. 1545-0074 (99) Guam Individual Income Tax Return 2012 DRT Use Only—Do not …

Individual Income Tax Return 62 Earned income credit. See instructions, 2012 Form 40N, Oregon Individual Income Tax Return for Nonresidents, Learn what you must do to meet your tax responsibilities if you receive income and what happens if you also have a student loan.

Form 1040 The Department of Revenue and Taxation OMB No. 1545-0074 (99) Guam Individual Income Tax Return 2012 DRT Use Only—Do not … IT-201-I Instructions New York State Department of Taxation and Finance Instructions for Form IT-201 Full-Year Resident Income Tax Return New York State • …

... Tax Year 2012 Individual Income Tax Statistics; Quarterly Income Tax Withholding Return NC-30: Income Tax Withholding Tables & Instructions … ND-1 Individual income tax return 2012 13. Nonresident only: Tax - If a full-year resident, enter amount from Tax Table on page 20 of instructions; however,

income tax return and pay the tax due in full on or withhold Iowa income tax. 2012 Iowa Income Tax Information See 2012 Expanded Instructions on the Find the 2012 federal tax forms you need. 2012 Income Tax Form Downloads. Individual Income Tax Return: 1040X:

OREGON 2012 40N Individual Income Tax Return

2012 DELAWARE 2012 Non-Resident Individual Income Tax Return. income tax return and pay the tax due in full on or withhold Iowa income tax. 2012 Iowa Income Tax Information See 2012 Expanded Instructions on the, Access forms, form instructions, and worksheets for each tax division below. 2012 Alabama Individual Income Tax Return – Full Year Residents Only:.

Tax Year 2012 Income Tax Forms. 2012 Individual Income Tax to File Personal Income Tax Return: Form and instructions for applying for a a nonresident amended return for tax year 2012., ND-1 Individual income tax return 2012 13. Nonresident only: Tax - If a full-year resident, enter amount from Tax Table on page 20 of instructions; however,.

Trinidad and Tobago Emolument Income Tax 2012

Trinidad and Tobago Emolument Income Tax 2012. Product Number Title Revision Date; Form 1040-A: U.S. Individual Income Tax Return 2017 Inst 1040-A: Instructions for Form 1040-A, U.S. Individual Income Tax Find the 2012 federal tax forms you need. 2012 Income Tax Form Downloads. Individual Income Tax Return: 1040X:.

Wisconsin Department of Revenue: 2012 Individual Income Tax Forms 2012 Form IL-1040 Instructions for taxpayers that were not required to file an Illinois Individual Income Tax return in the previous tax year.

2012 Form IL-1040 Instructions for taxpayers that were not required to file an Illinois Individual Income Tax return in the previous tax year. 2012 Individual Income Tax to File Personal Income Tax Return: Form and instructions for applying for a a nonresident amended return for tax year 2012.

Access forms, form instructions, and worksheets for each tax division below. 2012 Alabama Individual Income Tax Return – Full Year Residents Only: These modifications are to be made only for purposes of filling out the Foreign Earned Income Tax 2012 tax return in 2012. See the Instructions

These modifications are to be made only for purposes of filling out the Foreign Earned Income Tax 2012 tax return in 2012. See the Instructions Election of Composite Filing Composite returns for the 2012 calendar year must be filed by April 30, 2013. An automatic 6-month extension for filing is

2012 Kentucky Individual Income Tax Forms federal adjusted gross income (see instructions). If a taxpayer died before filing a return for 2012, Find the 2012 federal tax forms you need. 2012 Income Tax Form Downloads. Individual Income Tax Return: 1040X:

Get step by step instructions on how to file a tax amendment for various tax years. Form 500X (2012), Amended Individual Income Tax Return I've used e … Product Number Title Revision Date; Form 1040-A: U.S. Individual Income Tax Return 2017 Inst 1040-A: Instructions for Form 1040-A, U.S. Individual Income Tax

CITY OF CINCINNATI INDIVIDUAL INCOME TAX RETURN or within three months after final determination of your federal income tax 2012 Individual Return revised ... a federal individual income tax return, in the instructions. CONSUMER EXCISE TAX RETURN New for 2012. General Information for Filing Your 2012

Individual Income Tax Forms. 2012; Individual Income Tax Return Line-by-line K-40 and Schedule S Instructions - 2012; Individual Income Tax Tables These modifications are to be made only for purposes of filling out the Foreign Earned Income Tax 2012 tax return in 2012. See the Instructions

income tax return and pay the tax due in full on or withhold Iowa income tax. 2012 Iowa Income Tax Information See 2012 Expanded Instructions on the 2012 Kentucky Individual Income Tax Forms federal adjusted gross income (see instructions). If a taxpayer died before filing a return for 2012,

Get step by step instructions on how to file a tax amendment for various tax years. Form 500X (2012), Amended Individual Income Tax Return I've used e … Election of Composite Filing Composite returns for the 2012 calendar year must be filed by April 30, 2013. An automatic 6-month extension for filing is

Learn what you must do to meet your tax responsibilities if you receive income and what happens if you also have a student loan. ... a federal individual income tax return, in the instructions. CONSUMER EXCISE TAX RETURN New for 2012. General Information for Filing Your 2012