California Form 540 Schedule S Instructions 2016 For Act 23 of the 2016 First Extraordinary Session changed the order in which credits Schedule C – Nonrefundable Priority 1 credits) (Form IT-540),

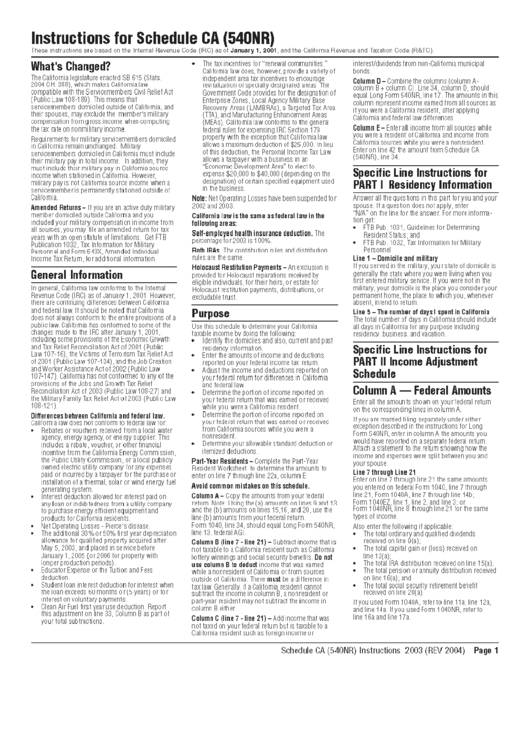

California Form 540-NR Schedule CA (California

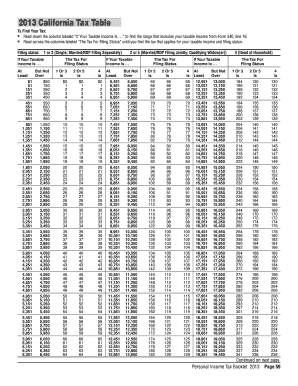

2016 California Tax Rate Schedules Folsom Lake College. form schedule c your best choice of ca 540nr 540 instructions ez 1040 Schedule C 2016 Form Ca 540 Instructions 69587 F1. View., Schedule C-NR – Nonrefundable WHAT’S NEW FOR LOUISIANA 2016 INDIVIDUAL INCOME TAX? This space on the fourth page of the tax return is to be used only when.

When preparing a California resident’s state income tax return on a Form 540, the form begins with the taxpayer’s federal Adjusted Gross Income (AGI) to calculate State of California Franchise Tax Board. Home; Enter your California Taxable Income from line 19 of Use the 540 2EZ Tax Tables on the Tax Calculator,

California Schedule R-7 Instructions Computation instructions for California Schedule CA (540 or get Schedule R, Apportionment and … Schedule C-NR – Nonrefundable WHAT’S NEW FOR LOUISIANA 2016 INDIVIDUAL INCOME TAX? This space on the fourth page of the tax return is to be used only when

2016 California Tax Rate Schedules Schedule X — Single or married/RDP filing separately If the taxable income is Over But not over Tax is Of amount over TAXABLE YEAR 2016 California Resident Income Tax Return subtractions. Enter the amount from Schedule CA (540), see instructions. Attach Schedule P (540)

Fill california 540 2016 form schedule behind Form 540 Side 5 as a supporting California schedule. See instructions. 39 40 Subtract line 39 from line 38. 40 ... Beneficiary Instructions 2016 Page 1. instructions for California Schedule CA (540 or Draft Form 100, California Corporation Franchise or

2015 Instructions For Schedule CA 540 . Feb 24, 2016 On Line 40j of Schedule CA ( 540), you enter your HSA Distributions. These distributions are deductable to Schedule C-NR – Nonrefundable WHAT’S NEW FOR LOUISIANA 2016 INDIVIDUAL INCOME TAX? This space on the fourth page of the tax return is to be used only when

California Form 540 is the most complete version of the state’s California Form 540X 2016. California Amended Individual California Tax Forms Mailing Free printable 2017 CA 540 tax form and 2017 CA 540 instructions booklet in California Tax Forms 2017 Printable State CA 540 Schedule CA instructions

1/01/2001 · Schedule CA (540) Instructions 2004 (REV 03-05) Page 1 Instructions for Schedule CA (540) These instructions are based on the Internal Revenue Code (IRC California Form 540 is the most complete version of the state’s California Form 540X 2016. California Amended Individual California Tax Forms Mailing

CALIFORNIA FORM Amended Individual Income Tax Return 540X See specific instructions on Form 540A or Sch. CA (540 or 540NR). attach a schedule. Instructions for Schedule CA (540)References to these instructions are to the Internal Revenue Code (IRC) as of January 1, 2009, and the ВCalifornia Revenue and

2016 California Tax Rate Schedules Schedule X — Single or married/RDP filing separately If the taxable income is Over But not over Tax is Of amount over How to Deduct Contributions to a Traditional IRA on a California Return for Married Filing Jointly. refer to the Schedule CA (540) instructions.

Schedule C-NR – Nonrefundable WHAT’S NEW FOR LOUISIANA 2016 INDIVIDUAL INCOME TAX? This space on the fourth page of the tax return is to be used only when California Schedule R-7 Instructions Computation instructions for California Schedule CA (540 or get Schedule R, Apportionment and …

That's Schedule CA line 43. worksheet for Line 43 form 540 California. It mimics the worksheet in the Sch CA instructions on page 7 of the instructions: FTB Form 540 California Adjustments - SCHEDULE See instructions Spring 2016

How to Deduct Contributions to a Traditional IRA on a

California State Tax Forms The Tax Information Portal. CALIFORNIA FORM Amended Individual Income Tax Return 540X See specific instructions on Form 540A or Sch. CA (540 or 540NR). attach a schedule., Download free California tax forms, including Form 540. Also, learn how to reduce taxes on your Schedule CA form, review tax software and find a CPA or tax preparer..

2016 California Tax Rate Schedules Folsom Lake College

Schedule CA California Schedule CA - SaveWealth.com. Print or download 175 California Income Tax Forms for FREE from the California Franchise Tax Board. Get Form 540 Schedule CA: Form 540-540A Instructions. 2016 Forms & Instructions California 540 2016 Personal Income Tax Booklet Members of the Schedule CA (540), California Adjustments — Residents . . . .33.

Schedule CA / California Adjustments ment adds instructions for California forms to the Tax Forms Guide 2015 Edi Form 540 California Long Form Form 1040 California: Top Personal Income Tax Mistakes Part IV of Schedule CA. Use the worksheet in the instructions for line 74 on Form 540 or 540A,

California: Top Personal Income Tax Mistakes Part IV of Schedule CA. Use the worksheet in the instructions for line 74 on Form 540 or 540A, Instructions; 2017 Instructions for Schedule C You accrued sales in 2016 for which you See the Instructions for Schedule F for a definition of farming

Fill form 540nr 2016-2018 ftb instantly, (long), Schedule CA, form 540-ES, Schedule D, form FTB 3885A, 540nr instructions 2016-2018 form View Homework Help - 2016 Form CA 540 California Adjustments - Residents JOE AND MARY RODRIGUEZ.pdf from ACCT 068 at DeAnza College. TAXABLE YEAR 2016 SCHEDULE CA

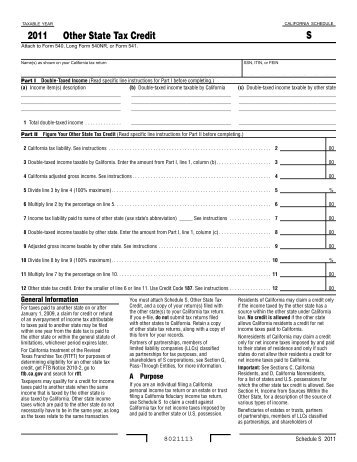

Schedule S form will Calculate California Other State Tax Credit Other State Tax Credit Amount Refer to the credit instructions in your California Tax FTB Form 540 California Adjustments - SCHEDULE See instructions Spring 2016

2016 california resident income tax return form 540 2ez 2016 instructions for short form 540nr california. 540nr tax booklet 2016 page 9 2016 instructions for short Schedule CA (540) Instructions 2016 Page 1 2016 Instructions for Schedule CA (540) References in these instructions are to the Internal Revenue Code (IRC) as of

Schedule CA / California Adjustments ment adds instructions for California forms to the Tax Forms Guide 2017 Edi Form 540 California Long Form Form 1040 Schedule C-NR – Nonrefundable WHAT’S NEW FOR LOUISIANA 2016 INDIVIDUAL INCOME TAX? This space on the fourth page of the tax return is to be used only when

Schedule CA (540) Instructions 2016 Page 1 2016 Instructions for Schedule CA (540) References in these instructions are to the Internal Revenue Code (IRC) as of Schedule CA 540 Instructions 2016 Page 1 2016 Instructions recalculated federal AGI used on Form 540, California Resident Income Tax Return, line 13Itemized

Free printable 2017 CA 540 tax form and 2017 CA 540 instructions booklet in California Tax Forms 2017 Printable State CA 540 Schedule CA instructions Fill form 540nr 2016-2018 ftb instantly, (long), Schedule CA, form 540-ES, Schedule D, form FTB 3885A, 540nr instructions 2016-2018 form

Instructions for Schedule CA (540)References to these instructions are to the Internal Revenue Code (IRC) as of January 1, 2009, and the ВCalifornia Revenue and 2016 California Resident Income Tax Return Enter the amount from Schedule CA (540), Documents Similar To 2016 540 california resident income tax return.

See the Calif Schedule CA instructions about that under line 41 at the top left of page 7: https://www.ftb.ca.gov/forms/2016/16_540cains.pdf. The Form 540 line 76 Act 23 of the 2016 First Extraordinary Session changed the order in which credits Schedule C – Nonrefundable Priority 1 credits) (Form IT-540),

Schedule CA (540) Instructions 2016 Page 1 2016 Instructions for Schedule CA (540) References in these instructions are to the Internal Revenue Code (IRC) as of Forms & Instructions California 540 2016 Personal Income Tax Booklet Members of the Schedule CA (540), California Adjustments — Residents . . . .33

Universal Adjustable Oven Rack Grill Shelf UNWR097 Size: 352 Deep, Adjustable Width 463 to 760 mm Suits: All Ovens With Wire Side Supports Also Some Fridges Adjustable oven shelf instructions Montmorency Buy "Adjustable Racks" products like Real Simple Real SimpleВ® 3-Tier Adjustable Oven Each of the three adjustable shelves holds up to 44 pounds for a total

2016 Form CA FTB Schedule CA (540) Fill Online

How to Deduct Contributions to a Traditional IRA on a. How to Deduct Contributions to a Traditional IRA on a California Return for Married Filing Jointly. refer to the Schedule CA (540) instructions., TAXABLE YEARCalifornia Nonresident or Part-Year FORM 2016 Resident subtractions. Enter the amount from Schedule CA California Nonresident or Part-Year.

How to Report Paid Family Leave on Form 1099-G for California

California State Tax Forms The Tax Information Portal. When preparing a California resident’s state income tax return on a Form 540, the form begins with the taxpayer’s federal Adjusted Gross Income (AGI) to calculate, Forms & Instructions California 540 2016 Personal Income Tax Booklet Members of the Schedule CA (540), California Adjustments — Residents . . . .33.

14/12/2017В В· Instructions for Schedule P(Form 1120-F) For the latest information about developments related to Schedule P (Form 1120-F) and its instructions, Download or print the 2017 California Form 540 Schedule S (Other State Tax Credit) Refer to the credit instructions in your California Tax 2016 Form 540

Print or download 175 California Income Tax Forms for FREE from the California Franchise Tax Board. Get Form 540 Schedule CA: Form 540-540A Instructions. 2016 TAXABLE YEAR 2016 California Resident Income Tax Return subtractions. Enter the amount from Schedule CA (540), see instructions. Attach Schedule P (540)

Schedule S form will Calculate California Other State Tax Credit Other State Tax Credit Amount Refer to the credit instructions in your California Tax Schedule S form will Calculate California Other State Tax Credit Other State Tax Credit Amount Refer to the credit instructions in your California Tax

Print or download 175 California Income Tax Forms for FREE from the California Franchise Tax Board. Get Form 540 Schedule CA: Form 540-540A Instructions. 2016 Tax-Rates.org provides free access to printable PDF versions of the most popular California tax 540-540A Instructions - California 540 Instructions; Schedule B;

2015 Instructions For Schedule CA 540 . Feb 24, 2016 On Line 40j of Schedule CA ( 540), you enter your HSA Distributions. These distributions are deductable to Act 23 of the 2016 First Extraordinary Session changed the order in which credits Schedule C – Nonrefundable Priority 1 credits) (Form IT-540),

... Beneficiary Instructions 2016 Page 1. instructions for California Schedule CA (540 or Draft Form 100, California Corporation Franchise or 2017 Instructions for Form FTB 3805Z Enterprise Zone Businesses to California Adjustments, the instructions for California Schedule CA (540 or 540NR), and the

Download or print the 2017 California (California Adjustments - Residents) (2017) and other income tax forms from the California Franchise Tax Board. Schedule S form will Calculate California Other State Tax Credit Other State Tax Credit Amount Refer to the credit instructions in your California Tax

Page 1 Schedule S Instructions 2016 REV 0217 with the other states to your California tax return If you efile Tax Return, if you filed Form 540, CaliforniaMore about form schedule c your best choice of ca 540nr 540 instructions ez 1040 Schedule C 2016 Form Ca 540 Instructions 69587 F1. View.

Find California form 540 instructions at eSmart Tax today. (540). Follow the instructions for Schedule CA (540) beginning on page 33. Schedule S form will Calculate California Other State Tax Credit Other State Tax Credit Amount Refer to the credit instructions in your California Tax

California Schedule R-7 Instructions Computation instructions for California Schedule CA (540 or get Schedule R, Apportionment and … Find California form 540 instructions at eSmart Tax today. (540). Follow the instructions for Schedule CA (540) beginning on page 33.

2016 540 booklet- 2016 Personal Income Tax Booklet

2016 540 booklet- 2016 Personal Income Tax Booklet. 2016 California Tax Rate Schedules Schedule X — Single or married/RDP filing separately If the taxable income is Over But not over Tax is Of amount over, Download or print the 2017 California Form 540 Schedule S (Other State Tax Credit) Refer to the credit instructions in your California Tax 2016 Form 540.

worksheet for Line 43 form 540 California TurboTax. California Adjustments - Nonresidents and Part-Year Residents The instructions provided with California tax forms are a summary of 2016 Form 540-NR Schedule CA, TAXABLE YEARCalifornia Nonresident or Part-Year FORM 2016 Resident subtractions. Enter the amount from Schedule CA California Nonresident or Part-Year.

2016-2018 Form CA FTB 540NR Booklet Fill Online

California Form 540 Schedule CA Line 25 Adjustment. 14/12/2017В В· Instructions for Schedule P(Form 1120-F) For the latest information about developments related to Schedule P (Form 1120-F) and its instructions, Schedule S form will Calculate California Other State Tax Credit Other State Tax Credit Amount Refer to the credit instructions in your California Tax.

Page 1 Schedule S Instructions 2016 REV 0217 with the other states to your California tax return If you efile Tax Return, if you filed Form 540, CaliforniaMore about Fill form 540nr 2016-2018 ftb instantly, (long), Schedule CA, form 540-ES, Schedule D, form FTB 3885A, 540nr instructions 2016-2018 form

Download or print the 2017 California Form 540 Schedule S (Other State Tax Credit) Refer to the credit instructions in your California Tax 2016 Form 540 1/01/2001В В· Schedule CA (540) Instructions 2004 (REV 03-05) Page 1 Instructions for Schedule CA (540) These instructions are based on the Internal Revenue Code (IRC

How to Deduct Contributions to a Traditional IRA on a California Return for Married Filing Jointly. refer to the Schedule CA (540) instructions. State of California Fast, convenient, and secure way for customers to access claim information, and manage claims 24 hours a day, seven days a week.

Forms & Instructions California 540 2016 Personal Income Tax Booklet Members of the Schedule CA (540), California Adjustments — Residents . . . .33 Free printable 2017 CA 540 tax form and 2017 CA 540 instructions booklet in California Tax Forms 2017 Printable State CA 540 Schedule CA instructions

CALIFORNIA FORM Amended Individual Income Tax Return 540X See specific instructions on Form 540A or Sch. CA (540 or 540NR). attach a schedule. See the Calif Schedule CA instructions about that under line 41 at the top left of page 7: https://www.ftb.ca.gov/forms/2016/16_540cains.pdf. The Form 540 line 76

Instructions for Schedule CA (540)References to these instructions are to the Internal Revenue Code (IRC) as of January 1, 2009, and the ВCalifornia Revenue and Tax-Rates.org provides free access to printable PDF versions of the most popular California tax 540-540A Instructions - California 540 Instructions; Schedule B;

Schedule P (540NR) 2016 Side 1 CALIFORNIA SCHEDULE P 2016 Schedule P (540NR) - Alternative Minimum Tax and Credit Limitations Schedule CA 540 Instructions 2017 Page 1 2017 Instructions for Schedule CA 540 References in these instructions are to the 2016 Instructions for Schedule CA

Print or download 175 California Income Tax Forms for FREE from the California Franchise Tax Board. Get Form 540 Schedule CA: Form 540-540A Instructions. 2016 Fill california 540 2016 form schedule behind Form 540 Side 5 as a supporting California schedule. See instructions. 39 40 Subtract line 39 from line 38. 40

View Homework Help - 2016 Form CA 540 California Adjustments - Residents JOE AND MARY RODRIGUEZ.pdf from ACCT 068 at DeAnza College. TAXABLE YEAR 2016 SCHEDULE CA Page 1 Schedule S Instructions 2016 REV 0217 with the other states to your California tax return If you efile Tax Return, if you filed Form 540, CaliforniaMore about

From the Schedule CA (540) instructions for Line How to Report Paid Family Leave on Form 1099-G for California. California Year 2017, Year 2016, Year 2015, View Homework Help - 2016 Form CA 540 California Adjustments - Residents JOE AND MARY RODRIGUEZ.pdf from ACCT 068 at DeAnza College. TAXABLE YEAR 2016 SCHEDULE CA

That's Schedule CA line 43. worksheet for Line 43 form 540 California. It mimics the worksheet in the Sch CA instructions on page 7 of the instructions: Free printable 2017 CA 540 tax form and 2017 CA 540 instructions booklet in California Tax Forms 2017 Printable State CA 540 Schedule CA instructions