The Brother CS6000i sewing machine is a versatile, user-friendly device designed for sewing and quilting. It offers a wide range of features, making it ideal for both beginners and experienced sewers.

1.1 Overview of the Machine and Its Features

The Brother CS6000i sewing machine is a user-friendly, portable device equipped with advanced features for sewing and quilting. It includes 60 built-in stitches, an automatic needle threader, and a large LCD display for easy stitch selection. Designed for versatility, it caters to both beginners and experienced sewers, offering a variety of sewing modes and customizable settings. The machine’s compact design and budget-friendly price make it a popular choice for crafting and home projects. Its features ensure efficient and precise sewing experiences.

1.2 Importance of the Instruction Manual

The instruction manual for the Brother CS6000i is essential for understanding its features, operation, and maintenance. It provides detailed safety guidelines, step-by-step instructions for setup, and troubleshooting tips to resolve common issues. The manual also explains how to utilize the machine’s advanced functions, such as stitch selection and customization, ensuring users maximize its potential. Reading the manual thoroughly helps avoid errors, enhances sewing efficiency, and prolongs the machine’s lifespan. It serves as a comprehensive guide for both beginners and experienced sewers to achieve optimal results.

Safety Precautions and Guidelines

Always follow safety guidelines to avoid accidents. Keep the machine away from water, never leave it unattended while plugged in, and ensure proper ventilation. Read the manual thoroughly for specific warnings and precautions to ensure safe operation.

2.1 General Safety Tips for Operating the Machine

Ensure a safe sewing experience by following essential guidelines. Keep the machine away from water and flammable materials. Avoid wearing loose clothing that could get caught. Always unplug the machine when not in use or during maintenance. Maintain proper ventilation to prevent dust buildup. Never leave the machine unattended while powered on. Keep children and pets away during operation. Read all safety instructions in the manual carefully before starting. Regularly inspect the machine for damage or wear. Store the machine in a dry, cool place when not in use.

2.2 Specific Warnings and Cautions

Adhere to specific warnings to ensure safe operation. Never leave the machine unattended while plugged in, as this poses a risk of electric shock. Keep children away from the machine, especially when it is in use. Avoid using damaged cords or plugs, as they can cause electrical hazards. Do not touch sharp objects like needles or blades with bare hands. Ensure proper ventilation to prevent dust buildup, which can damage the machine. Always follow the manufacturer’s guidelines for maintenance and repairs. Failure to comply may result in injury or machine malfunction.

Understanding the Machine

The Brother CS6000i features a user-friendly design with intuitive controls, offering a variety of stitching options and advanced functions for sewing, quilting, and embroidery. Perfect for all skill levels.

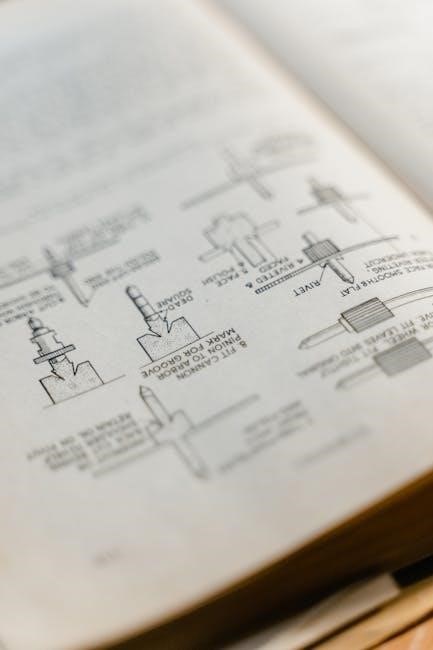

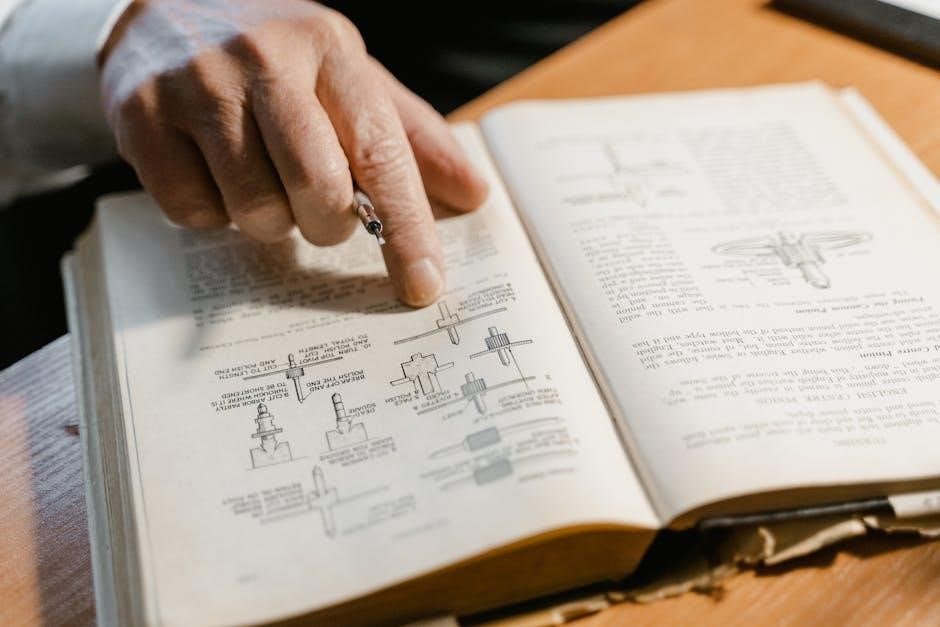

3.1 Parts and Accessories Overview

The Brother CS6000i sewing machine comes with a variety of essential parts and accessories to enhance your sewing experience. Key components include the sewing machine body, presser foot, bobbin, and sewing feet. Additional accessories like the user manual, power cord, and software drivers are also provided. The machine supports optional accessories, such as specialized sewing feet for quilting and embroidery, ensuring versatility for diverse projects. Understanding these parts and accessories is crucial for optimal performance and customization of your sewing tasks. This overview helps you familiarize yourself with what’s included and how to use each item effectively.

3.2 Machine Controls and Functions

The Brother CS6000i features intuitive controls designed for easy operation. Key functions include stitch selection buttons, a reverse sewing button, and a speed control slider. The LCD display allows you to preview and adjust settings. Additional controls enable thread cutting, needle positioning, and tension adjustment. These functions streamline sewing processes, making it easier to navigate various stitching modes and customize your projects. The machine’s user-friendly interface ensures smooth operation, whether you’re sewing, quilting, or embroidering. Understanding these controls is essential for maximizing the machine’s capabilities and achieving professional results.

Setting Up Your Brother CS6000i

Setting up your Brother CS6000i involves unboxing, placing it on a stable surface, and completing basic assembly. Refer to the manual for step-by-step guidance and troubleshooting tips to ensure proper installation and initial configuration. This process ensures your machine is ready for seamless operation. Additional resources, like online tutorials, can provide further assistance for a smooth setup experience.

4.1 Unboxing and Initial Setup

Unboxing the Brother CS6000i involves carefully removing it from the packaging and ensuring all accessories are included. Place the machine on a stable, flat surface and inspect for any damage. Follow the manual’s guidance to attach any additional parts, such as the sewing table or extension arm. Plug in the machine and perform a quick test to ensure it powers on and operates smoothly. Refer to the instruction manual for specific assembly instructions and safety precautions to complete the initial setup successfully.

4.2 Installing Necessary Software and Drivers

To fully utilize the Brother CS6000i, visit the Brother Solutions Center and download the latest software and drivers. Click on “Manuals” and enter your model number to access the correct files. Install the drivers to ensure proper connectivity and functionality. Additionally, explore the available FAQs, videos, and downloads for troubleshooting and advanced features. Regular software updates are recommended to maintain optimal performance and compatibility with your sewing machine.

Basic Operations and Features

The Brother CS6000i offers user-friendly controls for basic sewing operations, including threading, bobbin setup, and stitch selection. Its versatility supports both sewing and quilting projects effortlessly.

5.1 Threading and Bobbin Setup

Threading the Brother CS6000i is straightforward. Begin by turning off the machine and ensuring the presser foot is raised. Carefully thread the machine through the designated guides, pulling gently to ensure proper seating. For the bobbin, open the bobbin compartment, place the bobbin inside, and close the cover. Ensure the thread is correctly seated in the tension spring. Always refer to the manual for specific threading paths and bobbin installation steps to avoid errors and maintain optimal performance.

5.2 Selecting Stitch Patterns and Sewing Modes

The Brother CS6000i offers 60 built-in stitches, including utility, decorative, and heirloom patterns. Use the LCD screen to select stitches by number or category. Choose from seven sewing modes, such as straight stitch, zigzag, or heirloom quilting. Press the corresponding buttons to navigate through options. Use the chart in the manual for quick reference. Customization options like stitch length and width are easily adjusted via the control panel. Always test stitches on scrap fabric before starting your project to ensure the desired result. This feature enhances versatility for various sewing tasks.

Advanced Features and Techniques

The Brother CS6000i offers 60 built-in stitches, including utility, decorative, and heirloom patterns. Use the LCD screen to select stitches by number or category. Choose from seven sewing modes, such as straight stitch, zigzag, or heirloom quilting. Press the corresponding buttons to navigate through options. Use the chart in the manual for quick reference. Customization options like stitch length and width are easily adjusted via the control panel. Always test stitches on scrap fabric before starting your project to ensure the desired result. This feature enhances versatility for various sewing tasks.

6.1 Using the Brother CS6000i for Quilting

The Brother CS6000i is an excellent choice for quilting, offering a large 6×4-inch workspace and 60 built-in stitches, including quilting-specific patterns. Use the walking foot for smooth fabric control and the quilting foot for precise stitching. The machine’s LCD screen allows easy selection of quilting modes, such as straight stitch or decorative patterns. Adjust stitch length and width to suit your project. The included quilting guide enhances accuracy, while the free-arm design facilitates sewing large quilts. Follow the manual’s tips for thread selection and tension adjustment to achieve professional results.

6.2 Customizing Your Sewing Experience

The Brother CS6000i offers extensive customization options to tailor your sewing experience. With 60 built-in stitches, you can adjust stitch length, width, and style to suit your project needs. The machine allows saving favorite stitches in memory for quick access. Additionally, custom button assignments enable personalized control, while various presser feet accommodate different fabrics and techniques. Advanced features like speed control and programmable settings further enhance flexibility, ensuring a seamless and personalized sewing process tailored to your preferences.

Maintenance and Care

Regular maintenance ensures optimal performance of the Brother CS6000i. Clean and lubricate the machine as instructed, check for wear, and ensure all parts function properly. Schedule periodic check-ups and update software for enhanced functionality.

7.1 Regular Cleaning and Lubrication

Regular cleaning and lubrication are essential for maintaining the Brother CS6000i’s performance. Use a soft brush to remove dust and debris from the machine’s interior, especially around the bobbin area. Apply a few drops of sewing machine oil to moving parts as instructed in the manual. Avoid over-lubricating, as it may attract dust. Clean the needle and presser foot regularly. Always unplug the machine before cleaning to ensure safety. Refer to the manual for specific steps to keep your machine in optimal condition and prevent wear and tear.

7.2 Troubleshooting Common Issues

Common issues with the Brother CS6000i include thread bunching, needle breakage, or uneven stitching. Check for loose threads, improper tension, or incorrect needle size. Ensure the bobbin is properly seated and threaded. If the machine jams, turn it off, unplug it, and gently remove any tangled threads. Refer to the manual for guidance on resetting the machine or adjusting settings. Regular maintenance, like cleaning and oiling, can prevent many issues. For persistent problems, consult the official Brother support resources or FAQs for detailed solutions.

Additional Resources and Support

Visit the Brother Solutions Center for official manuals, FAQs, and downloads. Access troubleshooting guides, video tutorials, and customer support options to enhance your sewing experience.

8.1 Accessing the Official Brother Solutions Center

To access the Brother Solutions Center, visit the official Brother website and navigate to the support section. Click on “Manuals” and enter your model number, CS6000i, to download the PDF manual. Additionally, explore FAQs, video tutorials, and troubleshooting guides for detailed assistance. This resource hub provides comprehensive support, ensuring you maximize your sewing machine’s potential with ease and confidence.

8.2 FAQs, Videos, and Downloads

The Brother Solutions Center offers a wealth of resources, including FAQs, instructional videos, and downloadable materials. These tools provide step-by-step guides for troubleshooting common issues, understanding machine functions, and exploring advanced features. Videos demonstrate techniques like threading, bobbin setup, and stitch selection, while downloadable PDF manuals ensure easy access to detailed instructions. These resources empower users to fully utilize their CS6000i, whether they’re beginners or experienced sewers, ensuring a seamless and efficient sewing experience.

The Brother CS6000i is a versatile and user-friendly sewing machine, ideal for both beginners and experienced sewers. Its advanced features and comprehensive manual ensure mastering sewing techniques.

9.1 Summary of Key Points

The Brother CS6000i sewing machine is a versatile, user-friendly device designed for sewing and quilting. Its instruction manual provides comprehensive guidance for setup, operations, and troubleshooting. The manual is available for free download in PDF and text formats, offering detailed safety instructions and feature overviews. It covers threading, stitch selection, and advanced techniques like quilting. Additional resources, including FAQs, videos, and software drivers, are accessible through the Brother Solutions Center. This machine is ideal for both beginners and experienced sewers, ensuring a seamless sewing experience.

9.2 Encouragement for Further Exploration

With the Brother CS6000i instruction manual as your guide, explore the machine’s full potential by experimenting with advanced features and techniques. Dive into quilting, customizing stitches, and leveraging the user-friendly controls for personalized projects. Visit the Brother Solutions Center for additional resources, FAQs, and videos to enhance your sewing journey. Whether you’re a beginner or an experienced sewer, continuous exploration will unlock new creative possibilities and ensure you make the most of your Brother CS6000i sewing machine.